Estimated Tax Payments 2025 Penalty. Washington — the internal revenue service today reminded taxpayers who didn't pay enough tax in 2025 to make a fourth quarter tax payment on or before. If you miss an estimated quarterly tax payment, you will likely receive a penalty from the irs.

The finance (no 2) act 2025 has been notified on 16 th august 2025. It’s important to note that taxpayers.

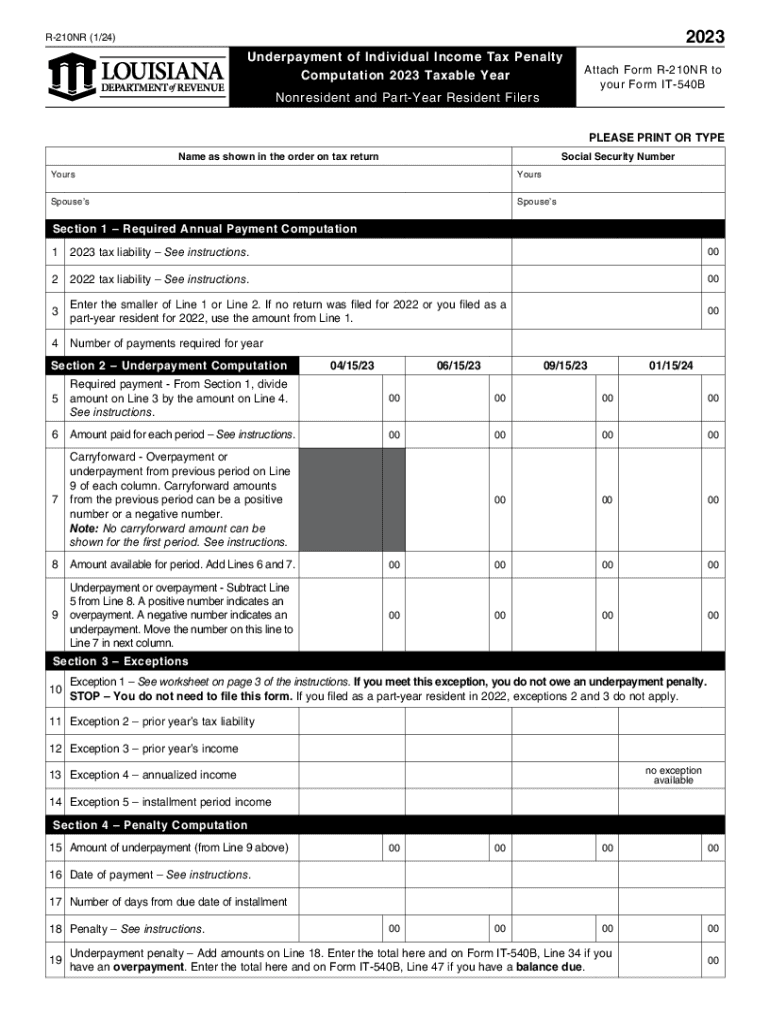

Irs Estimated Tax Payment Dates 2025 Darcy Melodie, Penalties for underpayment of estimated taxes.

Mo Estimated Tax Payments 2025 Amara Bethena, Illinois dor explains new law limiting nol deduction to $500k and resulting estimated payment implications.

Irs Estimated Tax Penalty Rate 2025 Doria, Normally, if you owe income taxes you have to pay by the april filing deadline (in 2025, the filing deadline is april 15) to avoid a penalty.

Underpayment of Estimated Tax by Individuals Penalty Fill Out and, This interview will help you determine if you’re required to make estimated tax payments for 2025 or if you meet an exception.

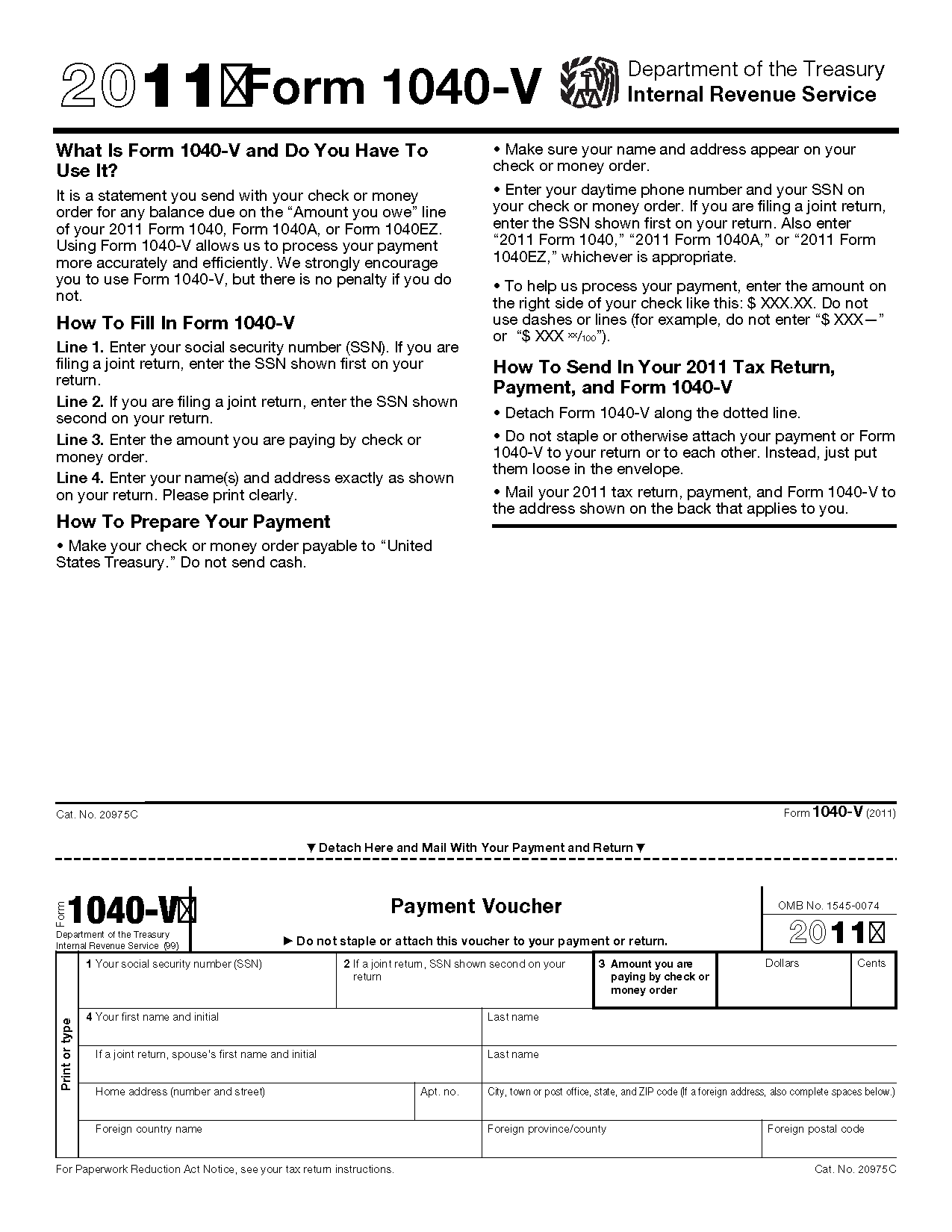

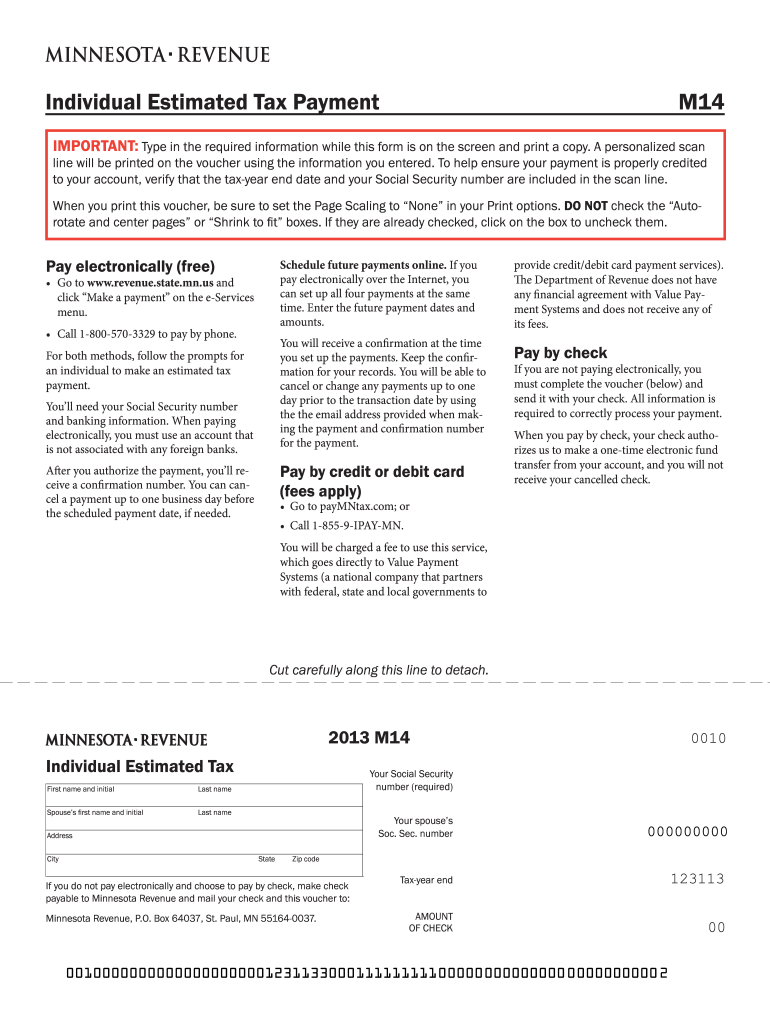

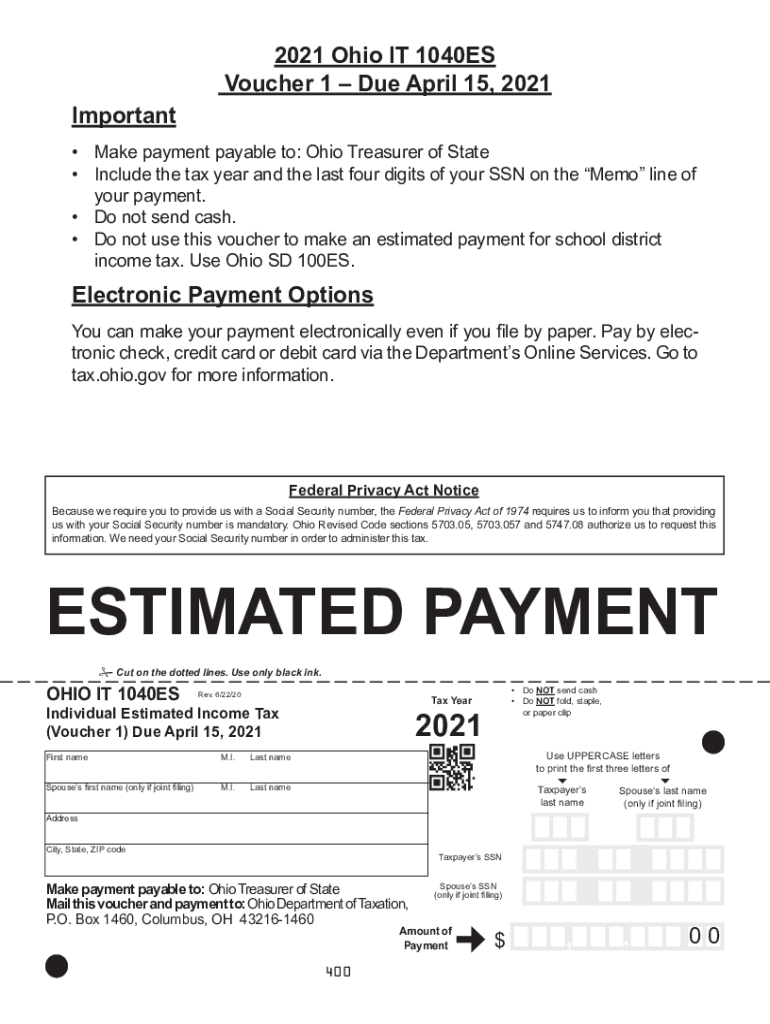

Estimated Tax Penalties, Estimated payments are due on april 15, june 15, september 15, and january 15 of every year.

Irs Estimated Tax Payments 2025 Worksheet Rayna Delinda, It’s important to know the deadlines to avoid.

Tax Due Dates For 2025 (Including Estimated Taxes), If you aren’t having taxes withheld from your paycheck, estimated quarterly taxes may be for you.

Pa State Estimated Tax Payments 2025 Ardis Katerine, How to get out of tax underpayment penalties.

Reeds Nautical Almanac 2025 Updates. Tide tables and tidal streams; Tide tables and tidal streams; Reeds nautical almanac is the[...]

When Is Women'S Day 2025 Usa. Dive into un women's exclusive editorial package this international women's day and discover the[...]

Dutchess County Fair 2025 Dates. Check the fair website for dates, admission fees, and parking information. Dutchess county fairgrounds, 6636[...]