403b 2025 Contribution Limits Over 50. The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. In 2025, employees aged 50+ can contribute up to $30,000 in total.

2025 403 (b) contribution limits. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you’re age 50 or older.

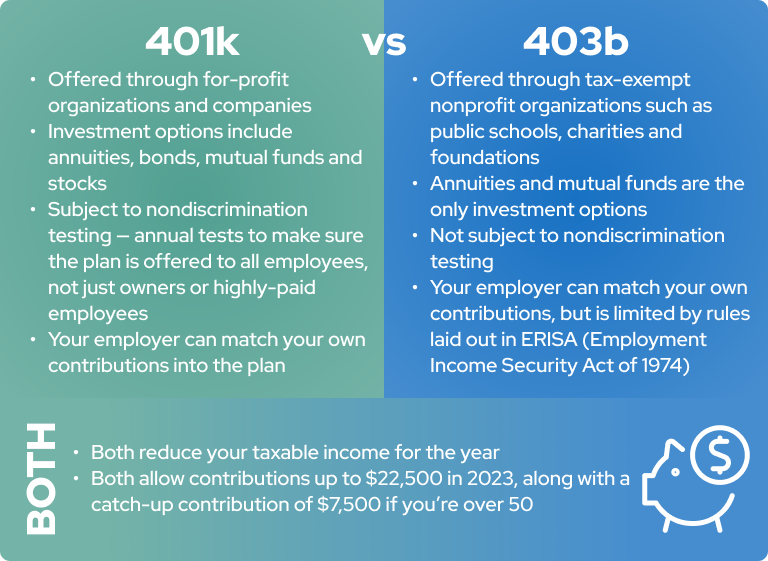

The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2025 to $23,000 in 2025 (compare that to the.

2025 Contribution Limits Announced by the IRS, There is an exception for employees over the age of. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

Simple Ira Contribution Limits 2025 Over Age 50 Katya Melamie, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2025 to $23,000 in 2025 (compare that to the. Learn about the 2025 contribution limits for different retirement savings plans.

Simple Ira Contribution Limits 2025 Over Age 50 Katya Melamie, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. Distributions for emergency personal expenses.

Roth IRA 401k 403b Retirement contribution and limits 2025, The internal revenue service recently announced the annual 403 (b) limits for 2025. Maximum salary deferral for workers:

415 Contribution Limits 2025 Perry Brigitta, If you're 50 or older, you can contribute an. 2025 403 (b) contribution limits.

Significant HSA Contribution Limit Increase for 2025, The internal revenue service recently announced the annual 403 (b) limits for 2025. Distributions for emergency personal expenses.

2025 Ira Contribution Limits Over 50 EE2022, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. For 2025, the limit on annual additions has increased from $66,000 to $69,000.

2025 Charitable Contribution Limits Irs Linea Petunia, For distributions made after december. In 2025, employees aged 50+ can contribute up to $30,000 in total.

401k Catch Up Contribution Limits 2025 Over 50 Kenna Alameda, It will stay the same at $7,500 in 2025. Learn about the 2025 contribution limits for different retirement savings plans.

403(b) Retirement Plans TaxSheltered Annuity Plans, In addition to higher contribution limits for 2025, the secure. For the 2025 plan year, an employee who earns more than.